First Internet Bancorp (INBK)·Q4 2025 Earnings Summary

First Internet Bancorp Q4 2025 Earnings: Recovery, NIM Expansion, Strong 2026 Guidance

January 29, 2026 · by Fintool AI Agent

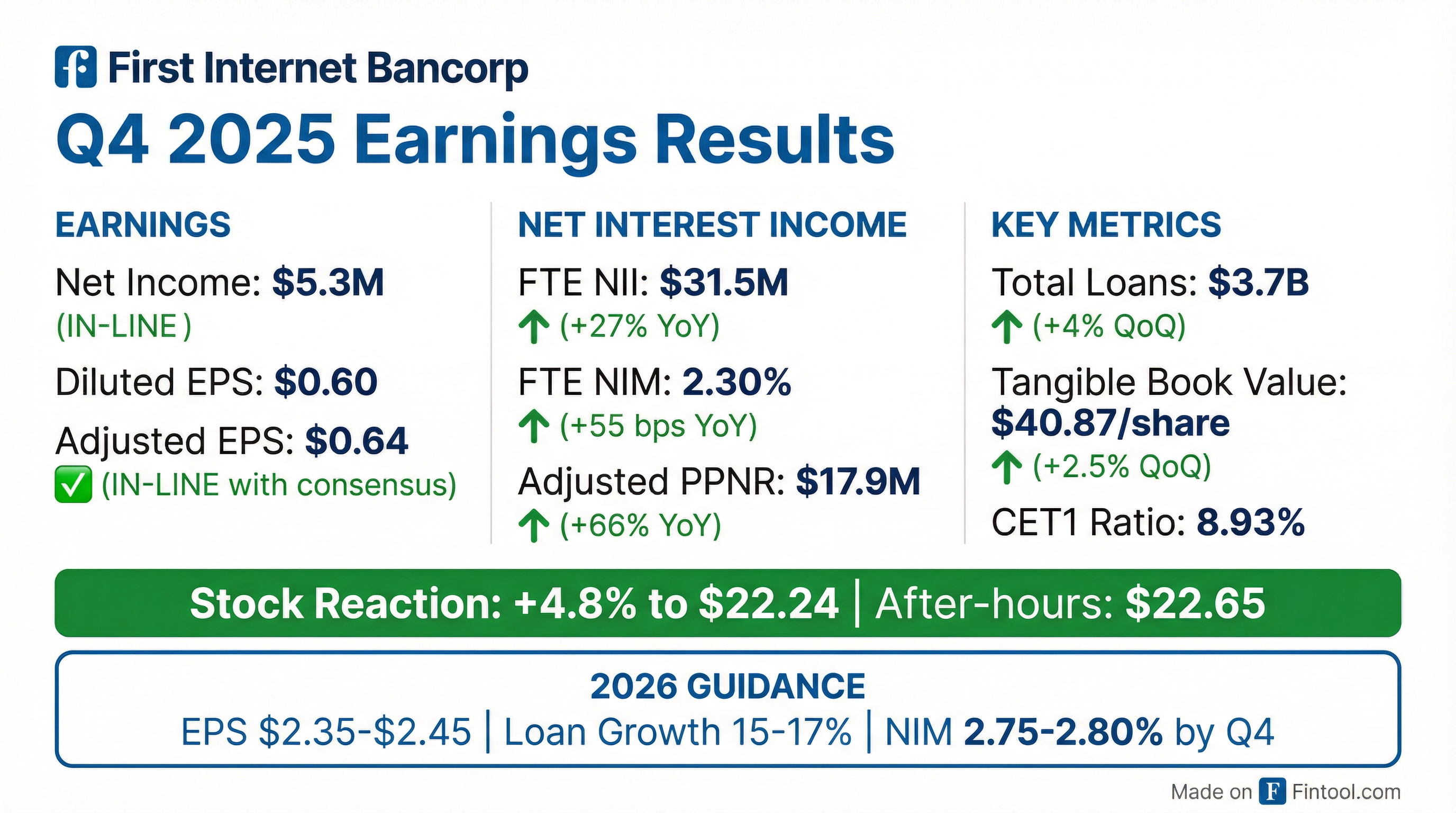

First Internet Bancorp delivered a solid return to profitability in Q4 2025, posting net income of $5.3 million ($0.60 diluted EPS, $0.64 adjusted) after a challenging Q3 marked by a significant loan portfolio sale . The digital banking pioneer's FTE net interest margin expanded 55 basis points year-over-year to 2.30%, driving adjusted pre-provision net revenue up 66% YoY to $17.9 million . Shares jumped 4.8% on the news, with management's bullish 2026 guidance of $2.35-$2.45 EPS signaling confidence in the recovery trajectory.

Did First Internet Bancorp Beat Earnings?

Adjusted EPS of $0.64 came in line with consensus, while GAAP EPS of $0.60 reflected a small loss on the residual single tenant lease financing (STL) loan sale .

The quarter was a stark contrast to Q3 2025's $41.6 million net loss, which included a $37.8 million pre-tax loss from the $850 million STL loan sale to Blackstone . With that transaction complete, INBK's earnings power is now visible again.

Historical EPS Trend (Adjusted):

The Q3 2025 loss was an anomaly driven by the strategic loan sale. The Q4 result demonstrates underlying earnings momentum.

What Drove the Strong Net Interest Income Growth?

The headline story is margin expansion. FTE net interest margin of 2.30% improved 55 bps YoY and 18 bps sequentially, driven by:

- Loan yield expansion: Portfolio yield increased to 6.39%, up 21 bps QoQ and 46 bps YoY

- Deposit cost reduction: Cost of interest-bearing deposits fell to 3.68%, down 19 bps QoQ and 45 bps YoY

- Fintech deposit optimization: Continued growth in fintech deposits allowed higher-cost CDs and brokered deposits to mature

Net interest income grew 29% YoY to $30.3 million (GAAP) and $31.5 million on an FTE basis . This represents nine consecutive quarters of interest income growth.

What Did Management Guide for 2026?

Management provided robust 2026 guidance that implies a significant earnings recovery :

The EPS guidance implies a dramatic turnaround from 2025's full-year loss of $4.03 per share . Key drivers include:

- Continued deposit repricing: $850M of CDs mature in next 6 months with a WAC of 4.15% vs. new CD WAC of 3.65% (50 bp benefit); fintech deposit spot rate already dropped from 3.52% to 3.35%

- Strong loan pipelines: Commercial lending pipelines heading into 2026 set the stage for continued NII growth

- Normalizing credit costs: Provision expected to remain elevated in H1 2026 ($17-19M in Q1, $14-16M in Q2) but improve in H2

- SBA retention strategy: Retaining additional ~$94M of SBA loans at prime +1.5, boosting NII but reducing gain on sale revenue to $19-20M (vs $29.4M in 2025)

- Tax rate benefit: Expecting 7-8.5% effective tax rate in Q1-Q2 due to depressed earnings, ramping to 10-12% in Q3-Q4

What Changed From Last Quarter?

Positive developments:

- Provision normalization: Credit provision of $12.0M was down 66% from Q3's elevated $34.8M

- Net charge-offs declining: NCOs/average loans improved to 1.68% from 1.89% in Q3

- Loan growth resumed: Total loans of $3.7B increased 4% QoQ driven by construction, single tenant lease financing, and small business lending

- Tangible book value growing again: TBV/share of $40.87 increased 2.5% QoQ

Ongoing challenges:

- NPLs elevated: Nonperforming loans to total loans of 1.56% (1.20% excluding guaranteed SBA balances)

- Full-year loss: 2025 ended with a net loss of $35.2M and EPS of -$4.03

- Credit normalization timeline: Management expects provision to remain elevated through H1 2026

What Did Analysts Ask About?

The Q&A session focused heavily on credit quality, NIM trajectory, and balance sheet dynamics. Key highlights:

On NIM Progression — CFO Ken Lavik expects 10-15 bps of margin expansion per quarter, with "a little bit more in the first quarter" as two Q4 rate cuts flow through fully .

On Credit Vintages — President Nicole Lorch provided critical color: "We're through the 2021, 2022, and even the 2023 vintages, I think, in terms of feeling the most pain. We are currently working through 2024 loans, and likely we will even have elevated levels of charge-offs compared to what we might like to see on the 2025 vintage that were underwritten under the previous guidelines."

On the 12-18 Month Risk Window — CEO David Becker noted SBA borrowers tend to hit problems in the 12-18 month window after acquisition. The team proactively contacted over 400 currently-performing borrowers to get ahead of potential issues .

On Criticized Loans — Total criticized loans increased approximately $16M or 10-11%, mostly in the special mention (not substandard) category .

On ACL Build — Management expects the allowance to grow $20-30M by year-end through a combination of specific reserves and loan growth .

On M&A Interest — In a notable disclosure, CEO Becker revealed: "We've been approached 3 or 4 times here over the last half of last year... It's probably the most activity we've seen more activity in the last 6 months than we had in the last 5 years put together." He mentioned international organizations seeking a US foothold and fintechs interested in their capabilities .

On Funding the Growth — With loan-to-deposit ratio at an "all-time low," INBK has flexibility to fund 15-17% loan growth through a mix of 8-10% deposit growth, deploying excess cash, and pulling fintech deposits back on balance sheet if needed .

How Did the Stock React?

INBK shares surged 4.8% to $22.24 on earnings day, with after-hours trading pushing the stock to $22.75. The positive reaction reflects:

- Relief that the troubled Q3 is behind them

- Strong 2026 EPS guidance ($2.35-$2.45)

- Continued NIM expansion trajectory

- Credit normalization underway

The stock trades at a significant 46% discount to tangible book value ($40.87/share), reflecting investor concerns about credit quality and the challenging 2025. With 2026 guidance implying ~10% ROE, the valuation gap could narrow if execution continues.

What Did Management Say?

CEO David Becker highlighted the resilience of INBK's digital banking model:

"We are pleased to close 2025 with strong fourth quarter results that demonstrate the resilience of our differentiated digital banking model. In 2025, we produced solid core financial performance as net interest income grew 30% year-over-year and delivered meaningful strategic accomplishments including the successful $850 million single tenant lease financing loan sale to Blackstone, exceptional growth in our Banking-as-a-Service initiatives and strategic investments in technology to further improve our credit underwriting and efficiency."

On credit quality and the path forward:

"Additionally, we took decisive and proactive measures to address credit challenges in our SBA and franchise finance portfolios through enhanced underwriting standards, and improved collection and risk management through strategic investments in AI and automation. As a result, we expect gradual credit improvement in the second half of this year."

On M&A interest (a notable disclosure during Q&A):

"Being honest, I can say we have been approached 3 or 4 times here over the last half of last year. We entertain all inquiries, we speak and talk. We've had a couple international organizations that are wanting a foothold here in the United States that are interested in us... It's probably the most activity. We've seen more activity in the last 6 months than we had in the last 5 years put together."

How Is the BaaS/Fintech Business Performing?

Banking-as-a-Service continues to be a standout growth driver. Key metrics from Q4:

Key Partnerships:

- Ramp — Largest deposit source via business savings and bill pay products

- Increase — Deposit and payments partner; INBK won "Payments Innovation of the Year" from American Banker for High-Fidelity ACH work

- Jaris — Embedded finance lending partnership contributing to interest income

- Pool — New group deposit account product launching "in the next couple of days"

The fintech deposit model provides significant flexibility — deposits can be moved on/off balance sheet, earning spreads in either position. On December 31, the spot rate on on-balance sheet fintech deposits was 3.52%, dropping to 3.35% by earnings day .

President Lorch emphasized the strategic approach: "We've been deliberately selective in bringing aboard new programs... we're getting calls all the time, and we have a great pipeline of new opportunities. But we are looking for programs that we think offer something special."

Loan Portfolio Breakdown

Total loans of $3.7 billion break down as follows :

The portfolio shift following the Blackstone STL sale has diversified concentration, with construction/investor CRE now the largest segment.

Capital Position

INBK maintains solid capital ratios despite the challenging 2025 :

The company repurchased 27,998 shares during Q4 at an average price of $18.64/share .

What Is the Credit Quality Outlook?

Management provided detailed color on the credit trajectory, including vintage analysis that frames the path forward:

Vintage Analysis:

- 2021-2023 vintages: Past peak pain

- 2024 vintage: Currently working through

- Early 2025 vintage: May see elevated charge-offs (underwritten under previous guidelines)

- H2 2025+ originations: New stricter guidelines taking effect

SBA Risk Profile:

- Business acquisition loans face "transition risk" as new owners take over

- 12-18 month window is when problems typically surface

- Team proactively contacted 400+ currently-performing borrowers to identify early warning signs

Franchise Finance Progress:

- Portfolio naturally decreasing as INBK ceased purchasing loans

- Remaining borrowers tend to be stronger multi-unit operators

- ApplePie Capital serving as intermediary providing brand support

Collection Wins: Management highlighted that recoveries in Q4 and into January "came in higher than expected" on several loans — a positive surprise from the special assets team's work .

Key Risks to Watch

- Credit quality: NPLs at 1.56% (1.20% ex-guaranteed balances); provision guidance of $50-53M for 2026; criticized loans up $16M QoQ

- Early 2025 SBA vintage: Loans originated under previous guidelines may generate elevated charge-offs in H1 2026

- Rate sensitivity: Fintech deposits indexed to Fed Funds; no rate cuts assumed in 2026 guidance

- Government shutdown risk: SBA secondary market sales were affected; first quarter non-interest income dependent on shutdown resolution

Bottom Line

First Internet Bancorp's Q4 2025 results mark a clear inflection point. After a difficult 2025 dominated by a strategic loan sale and elevated credit provisions, the company is positioned for a strong 2026. With FTE NIM on track to reach 2.75-2.80% by Q4 2026, loan pipelines solid, and credit normalization underway, management's $2.35-$2.45 EPS guidance appears achievable.

The vintage analysis provides important visibility: 2021-2023 vintages are past peak pain, with 2024 loans currently working through and potential elevated charge-offs from early 2025 originations still ahead. The proactive outreach to 400+ borrowers and investment in predictive analytics suggest management is getting ahead of problems.

At 0.54x tangible book value with growing M&A interest (3-4 approaches in 6 months — "more activity than the last 5 years combined"), the stock offers multiple paths to value realization. Investors should monitor credit quality trends closely as the SBA and franchise portfolios work through remaining problem loans, with H1 2026 expected to remain challenging before improvement in H2.

Data sourced from First Internet Bancorp Q4 2025 earnings call transcript and 8-K filed January 29, 2026, and S&P Global.